The Rising Demand for Low-Carbon Hydrogen and the Green Hydrogen Market

Abstract

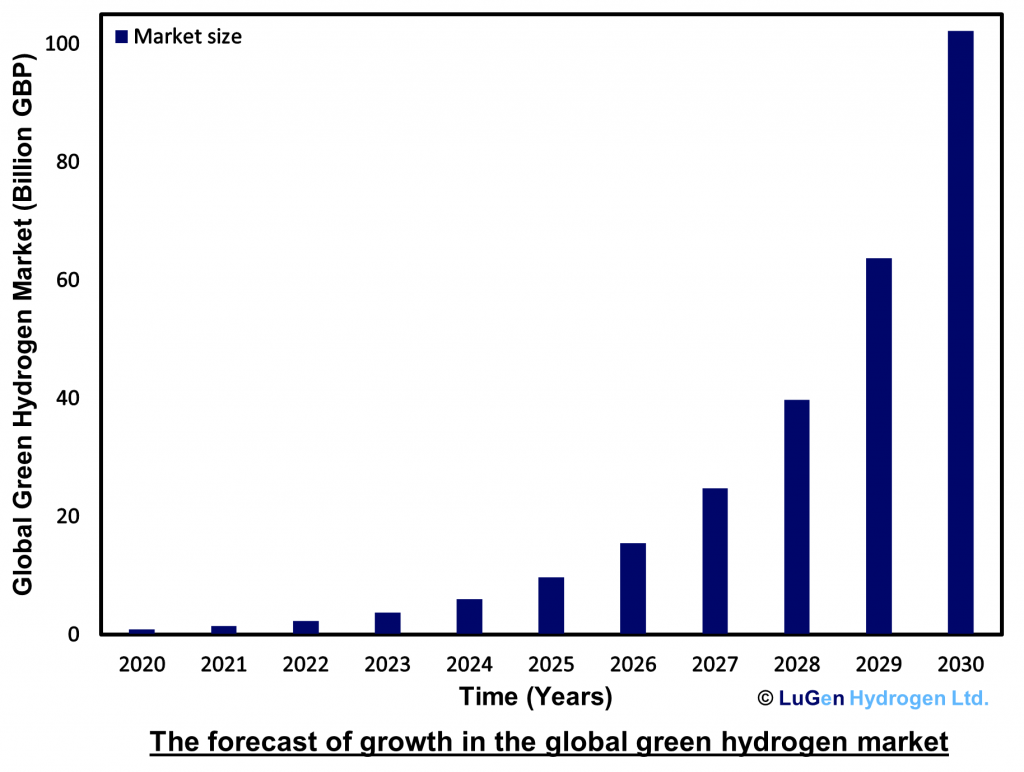

The demand for low-carbon hydrogen is expected to rise significantly by 2050, driven by energy security and net zero promises in various industries such as power, steel, shipping, and aviation. The global commitment to reducing carbon footprints and transitioning to cleaner energy sources will likely lead to a surge in demand for green hydrogen. According to reports and research, the global market for green hydrogen is projected to reach 103 billion GBP by 2030 and continue growing until 2050 to achieve carbon neutrality. The International Renewable Energy Agency (IRENA) predicts that global hydrogen demand will rise to 614 million metric tons per year by 2050, which would meet 12% of the total energy use. IRENA’s World Energy Transitions Outlook sees hydrogen covering 12% of global energy demand and cutting 10% of CO2 emissions by 2050.

1. The Global Hydrogen Market: An Overview

The demand for low-carbon hydrogen will rise from less than 1 Mt today to up to 223 Mt by 2050. Demand will be driven by energy security and net zero promises in a variety of industries, including power, steel, shipping, and aviation [1]. The global commitment to reducing carbon footprints and transitioning to cleaner energy sources is expected to drive a significant surge in demand for green hydrogen. As countries around the world adopt ambitious sustainability goals, the demand for green hydrogen will likely increase rapidly. According to a report generated by Precedence Research, the global market of green hydrogen is expected to rise to 103 billion GBP by 2030 and is expected to grow till 2050 to achieve carbon neutrality [2], [3].

Figure 1: The forecast of growth in the global green hydrogen market shows an exponential growth trend towards 2030. Data for this graph has been supplied by Precedence research, 2023

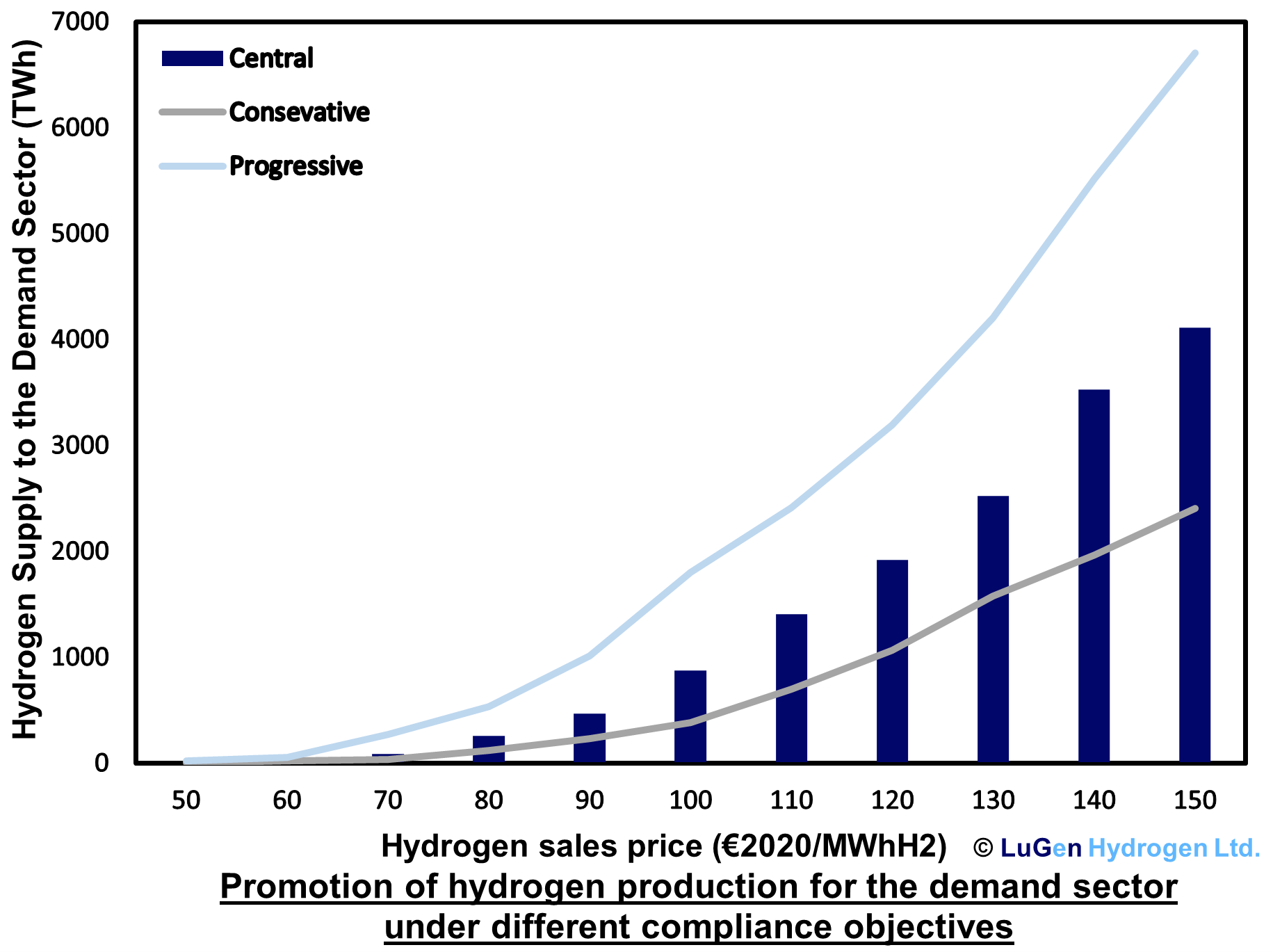

Further, Hydrogen adoption will not only benefit the transition, but it is expected to account for approximately 3% in global energy demand by 2050 [4]. Currently, more than 50% of hydrogen is produced through steam reforming of natural gas, 30% from naphtha reforming from refinery off-gases, about 18% from coal gasification and less than 5% from renewable energy sources (RES) [5]. Benjamin Lux at the Fraunhofer Institute for Systems and Innovation Research, Germany found in his study “A supply curve of electricity-based hydrogen in a decarbonized European energy system in 2050” shows a disproportionate rise in the amount of hydrogen that is readily available for the demand sectors with rising hydrogen prices.

The potential hydrogen supply grows in the scenario with the centre parameter from 0 TWh of H2 at a sales price of 50 €2020/MWhH2 to 4111 TWh of H2 at a sales price of 150 €2020/MWhH2. In compliance with the 1.5 °C target, the long-term strategic vision of Europe it is assumed that by 2050, hydrogen demand in Europe for industry, transportation, residential, and services will range from around 1536 TWh of H2 to 1953 TWh of H2 [6].

Figure 2: The promotion of hydrogen production through various compliance objectives. Here the progressive scenario where an aim of complying to a 1.5°C temperature rise is made. Such progressive measures and commitments are shown to increase the supply of hydrogen to the market. Data for this graph has been supplied by Lux, 2020

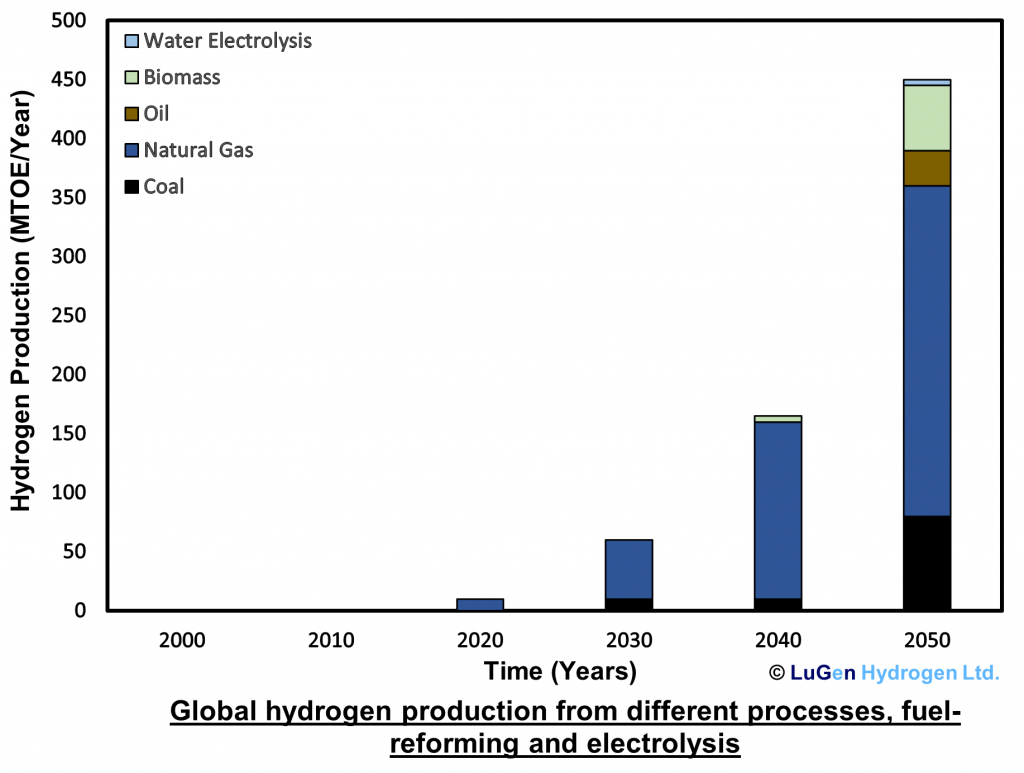

The growing demand of hydrogen and commitments made by governments have driven the production means of hydrogen. Chapman in his recent study indicated that in 2020 only a small amount of hydrogen was being produced from natural gas, but the growing demand has allowed industries and major players to explore other production means, which include water electrolysis. Electrolysis shown to increase in coming year for hydrogen production and expected to increase from 0 in 2020 to 11.11 % by 2050 [4].

Figure 3: Global hydrogen production from energy sources, reprocessed into hydrogen. Natural gas is shown here to be a major contributor in the transition to green hydrogen production. The gas-steam reformation process is a pathway to greater hydrogen production means and utility. Data for this graph has been supplied by Chapman, 2019

Although there is an increase in the demand and production of hydrogen globally, a gap exists where production does not sufficiently meet demand. This gap continues to persist due to market barriers. A few of these barriers include a lack of confidence in safe operation of appliances, lacking consumer awareness of the benefits of hydrogen, the commercial boiler and catering market may also be of lower interest to manufacturers due to the small size of this market sector compared to the domestic and industrial sector. Considerable investment in infrastructure is required for product development which requires policy direction [7]. Overcoming these barriers can further hasten the development of hydrogen projects and goals.

1.1. Global Hydrogen Market Summary

The demand for low-carbon hydrogen is projected to experience a significant surge in the coming decades. As countries strive to meet energy security and net-zero commitments, industries such as power, steel, shipping, and aviation are expected to drive the demand for green hydrogen. The global market for green hydrogen is predicted to reach a substantial value, with estimates of £103 billion by 2030. Additionally, hydrogen adoption is anticipated to account for approximately 3% of global energy demand by 2050.

Currently, the majority of hydrogen production relies on fossil fuel sources, but there is a growing emphasis on renewable energy-based electrolysis. Studies indicate that hydrogen production through electrolysis is expected to increase from negligible levels in 2020 to 11.11% by 2050, contributing to the overall supply. While there is a positive trend towards hydrogen production and demand, certain barriers need to be overcome to fully realise the potential.

Market barriers such as lack of confidence in safe operation, limited consumer awareness, and infrastructure investment requirements can impede the development of hydrogen projects. Addressing these challenges through policy direction and targeted efforts can help bridge the gap and accelerate the timely achievement of hydrogen-related goals. Overall, the increasing demand for low-carbon hydrogen, coupled with the commitment of governments and advancements in production technologies, presents a significant opportunity for the global hydrogen industry. By overcoming market barriers and fostering a supportive ecosystem, hydrogen can play a crucial role in achieving sustainable and carbon-neutral energy systems in the future.

2. The UK Hydrogen Market

Climate change is one of the most challenging problems that modern-day Britain is dealing with. The UK has been effective in reducing national greenhouse gas emissions by 45.21 % since 1990. This is mostly due to a decrease in the amount of coal used to generate electricity and an increase in the amount of electricity generated from renewable sources [8].

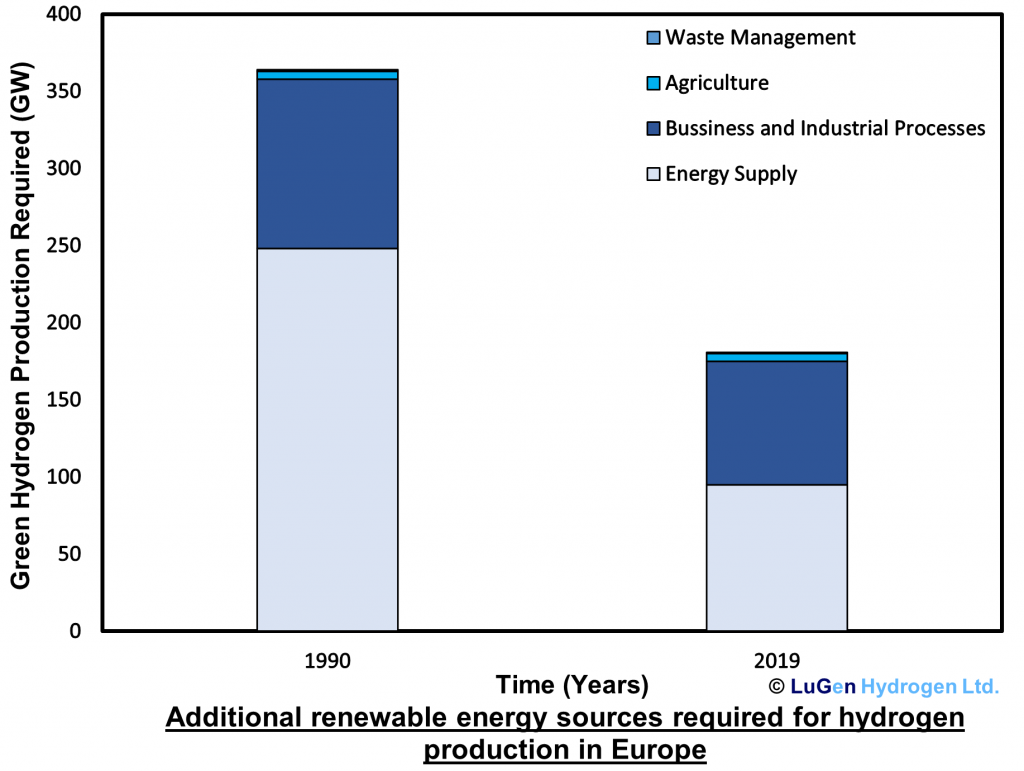

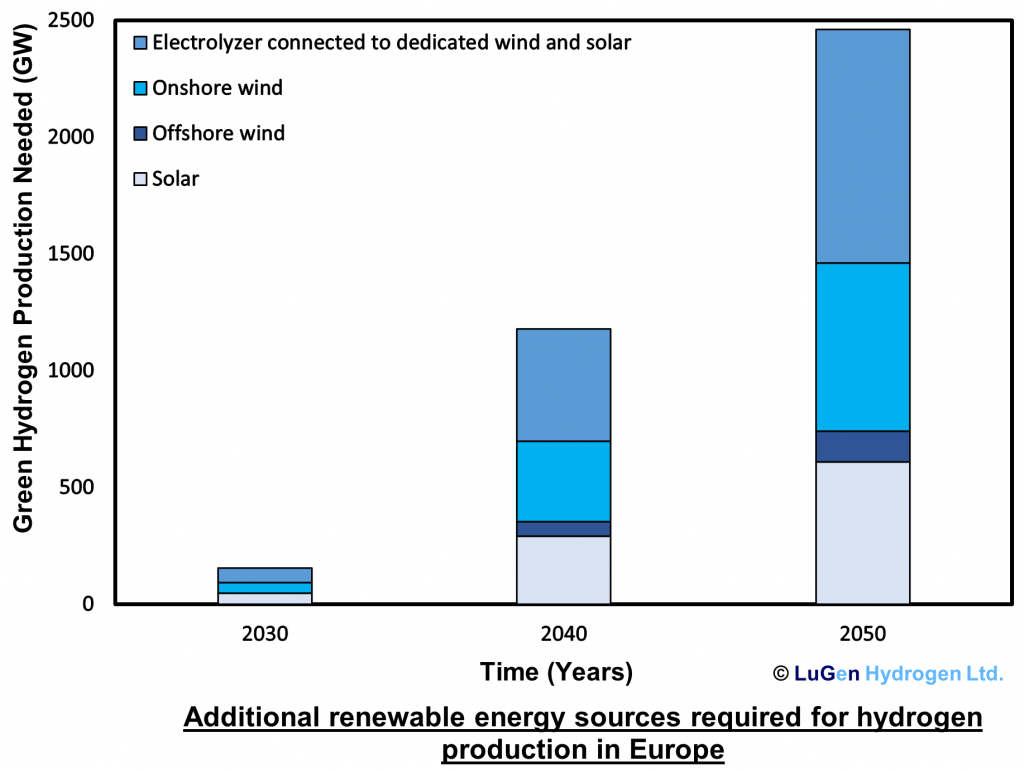

Figure 4: The additional requirement of renewable energy sources to generate green hydrogen in Europe, shows that electrolysers are largely connected to dedicated wind-solar power plants to meet the production requirement. Growth in the offshore renewable sector is also expected. Data for this graph has been supplied by Edwards, 2021

In Figure 4. 2019 saw 19.8%, 11.5%, and 4% of the total electricity generated in the UK come from onshore and offshore wind, bioenergy from waste, solar photovoltaics, and waste bioenergy. In total, 37.1% of the electricity produced in the UK was derived from renewable sources [9]. Despite this, significant action must be taken to tackle the decarbonization of high emitting sectors if we are to meet our ambitious net-zero targets [10]. Increasingly, more people believe that the most basic element in the periodic table, Hydrogen, holds the key to the modern energy crisis in the context of climate.

Ultra low-carbon to no-carbon hydrogen can be produced from water using an electrolyzer powered by renewable energy, or from natural gas with residual carbon being absorbed and stored underground, referred to as ‘green hydrogen’ and ‘blue hydrogen’ respectively. Industrial activities like steelmaking, in which fossil fuels serve as both chemical reagents and energy sources, as well as modes of transportation, such as shipping, will require longer ranges than battery-powered vehicles with battery technology currently available, there is also a benefit of hydrogen leading the transition ability to help decarbonize these industrial activities. In 2017, Britain became the twelfth nation to publish a hydrogen policy. By 2030, it demanded 5 GW of low-carbon hydrogen generation capacity, which is equivalent to 2% of present energy demand. Further the government in April doubled this goal [11].

2.1. Hydrogen Strategy and Initiatives of The UK Government

In the Hydrogen Strategy Roadmap, which was released in the UK Hydrogen Strategy (Aug 2021) [12] and outlined important strategic decisions and milestones to 2030 and beyond, the government laid out its plans. These decisions include the one about the up to 20% by volume hydrogen blending into gas distribution networks, anticipated in 2023, and the strategic choice regarding hydrogen for heat in 2026, which will be influenced by the 100% hydrogen “Neighbourhood Trial” and “Village Trial” scheduled for 2024 and 2025, respectively. Future policy will also be guided by trials of hydrogen and battery-powered HGVs to determine their viability, deliverability, prices, and benefits. In addition to already-announced support programmes for the hydrogen supply chain, the government continues to review the need for suitable market intervention to boost hydrogen to power generation. All of these choices will likely have a significant impact on the overall amount of hydrogen utilised in the UK energy system as well as the infrastructural and technological requirements through 2050, and they will also likely have an impact on the type and timing of additional choices in the future. The UK government outlined its best current understanding of the range of hydrogen production and use in 2050 in the UK Hydrogen Strategy. Analysis found in the UK Hydrogen Strategy suggested that low carbon hydrogen use might rise from its current low level to 20–35% of the UK’s final energy consumption in 2050, or 250–460 TWh, or about the same as current electricity use.

The increased ambition set forth under the British Energy Security Strategy (BESS), which calls for up to 10GW of low carbon hydrogen production capacity by 2030, with at least half of this electrolytic hydrogen, as well as the direction of travel indicated in the UK Hydrogen Strategy and its subsequent updates, reflect the potential effects on system resilience and energy security, particularly in terms of low carbon hydrogen production.

The UK government has allocated more than £346 million for CCUS Research, Development, and Deployment (RD&D) between 2004 and 2021. With the help of this financing, the UK has been able to maintain its leadership in CCUS research and innovation. advancing the technology, information, and abilities that will enable the UK to use CCUS domestically and sell its know-how abroad. The UK government announced in 2020 that two of the ten priority areas of the $1 billion Net Zero research Portfolio (NZIP) would be Advanced CCUS and Greenhouse Gas Removal (GGR) research. The following money is being offered specifically under the five-year NZIP (2021-2025):

The UK government has allocated £100 million (£70 million from NZIP and £30 million from NERC) towards the study and creation of demonstration facilities for the GGR and Direct Air Capture (DAC) technologies. Supporting the eventual deployment of First-of-a-Kind commercial GGR facilities in the UK and developing the know-how and technology for prospective export are the goals of this.

The Hydrogen Bioenergy with Carbon Capture and Storage (BECCS) Innovation Programme has received £30 million in funding to support technologies that can generate hydrogen from biogenic feedstocks and combine that production with carbon capture to achieve negative greenhouse gas emissions. Phase 1 of the scheme sponsored 22 projects in 2022 for a total of £5 million in order to scope and create a workable prototype demonstration project that would be carried out in Phase 2. The most promising initiatives from Phase 1 will be supported in their physical demonstration from 2023 to 2025 during Phase 2 (a total budget of £25 million).

A grant of £20 million has been given to CCUS Innovation 2.0 in order to create and test next-generation CCUS technology in the UK that can drastically lower the cost of CCUS deployment. Prior innovation support from BEIS (and its predecessor DECC) was crucial in the development of the Allam-Fetvedt Cycle from 8 Rivers, the CycloneCC technology from Carbon Clean, and the award-winning non-amine solvent from C-Capture.

UK institutions and businesses can now collaborate with their European and international colleagues in the third call of the worldwide Accelerating CCS Technologies (ACT-3) programme thanks to £5 million in financing. The UK participated in the first three ACT calls, which together sponsored joint CCUS innovation projects worth over €96 million, as a founding member of the global ACT initiative.

By 2030, the UK now hopes to produce up to 10GW of low-carbon hydrogen thanks to the BESS.

The government continues to fund and support research and studies to comprehend, develop, and commercialise a variety of hydrogen technologies across many end uses because hydrogen use is still in many cases in its infancy. This is done to aid the market in choosing the most effective combination of technology. In order to create proof on the end-to-end conversion of industrial fuel to hydrogen, the government, for instance, has funded nine feasibility studies through the £26 million Industrial Hydrogen Accelerator competition;

Awarded over £12 million through the second round of the Clean Maritime Demonstration competition, with seventeen projects exploring the use of hydrogen and/or hydrogen derived fuels in clean maritime solutions. Progressed 21 phase 1 feasibility projects as part of the £55 million Industrial Fuel Switching 2 competition.

2.2. The Hydrogen Production Capacity Gap in The UK

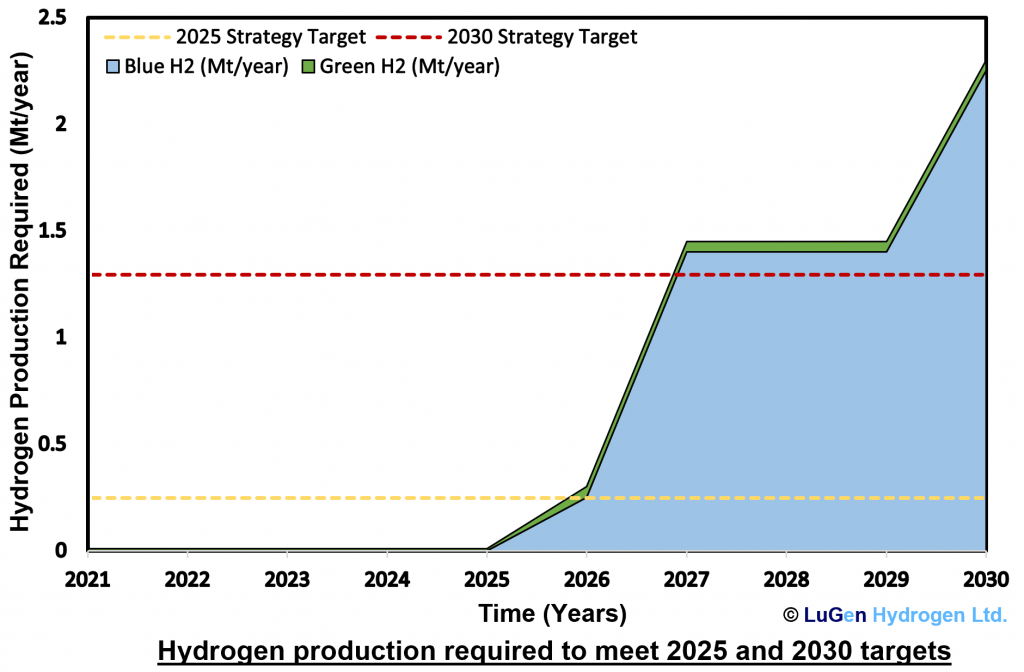

The entire green hydrogen production capacity for projects that have been announced and have online dates through 2030 is only 44,000 mt/year, according to Platts Analytics’ Hydrogen Production Asset Database. These projects typically have a low capacity of 2,277 metric tonnes H2 per year (mt/year). The UK’s declared low carbon hydrogen target of 5 GW (1.31 million mt/year) is far exceeded by our entire blue hydrogen project capacity for 2030, which is 2.26 million mt/year. Three sizable projects (Humber Zero VPI Immingham: DelpHYnus: HyNet North West) with in-service dates between 2027 and 2029 are driving this capacity, and will be producing hydrogen from natural gas and sequesting the associated CO2 emissions. Projects using blue hydrogen in the UK are often substantially bigger, averaging around 320,000 mt/year. The UK’s interim 2025 objective of 1 GW of clean hydrogen (260,000 mt/year) is not met by the majority of announced projects with online dates prior to the database, which are more immediate [13]. This existing gap can be met by getting all possible small as well as large plants on an immediate basis.

Figure 5: Hydrogen production requirements that are required to meet 2025 and 2030 strategy targets the UK. The trend shows major supply from the blue hydrogen sector, green hydrogen also shows a smaller but consistent growth strategy to 2030. Data for this graph has been supplied by S&P, 2021

3. The Hydrogen Markets in Germany

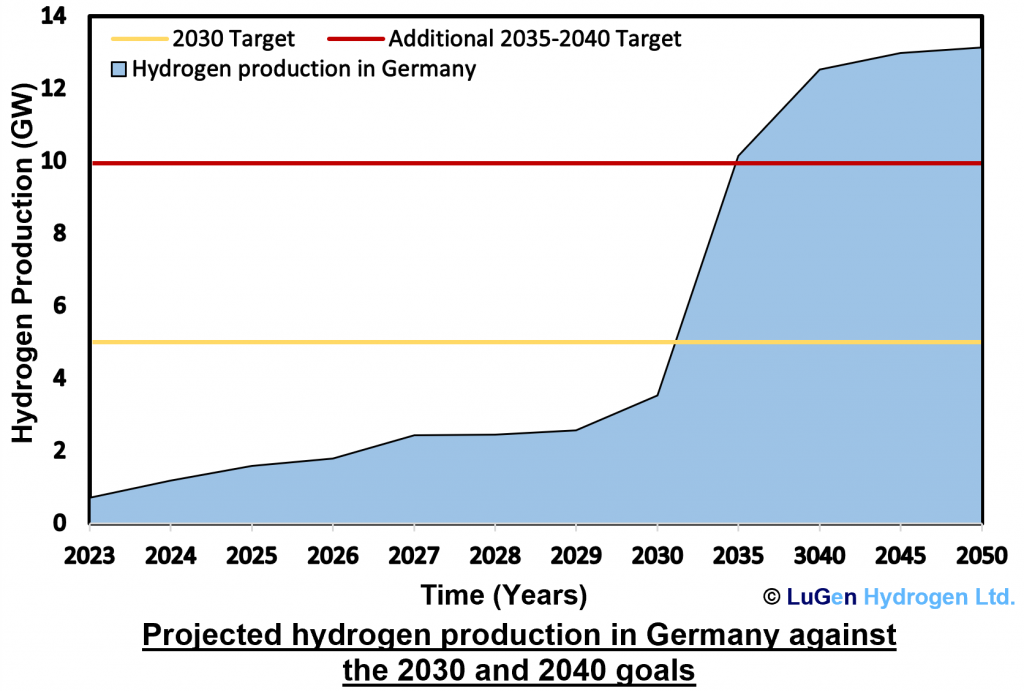

The National Hydrogen Strategy of Germany has been adopted and presented on June 10th, 2020. The German hydrogen strategy is supposed to develop the value chain for green hydrogen and to enable rapid rollout in Germany. It envisages a production threshold of 5 GW of renewable hydrogen in Germany by the year 2030. To this end, Germany will invest $22.83 billion by 2026 in the development of the German hydrogen economy and related development projects [5]. Based on an article in the Tagesspiegel’s energy policy backgrounder. Germany will require 95–130 terawatt hours (TWh) of hydrogen, including derivatives like ammonia, methanol, or synthetic fuels. Of this amount, 55 TWh would be produced using natural gas (also known as “grey” hydrogen) and 40–75 TWh would be produced using renewable energy sources (also known as “green” hydrogen).

The initial 2020 strategy made a 90–110 TWh demand assumption. According to the draught, imports would provide coverage for fifty to seventy percent, and the government intends to create an import strategy this year. The target electrolysis capacity of 10 gigawatts (GW) was previously agreed upon by the government combination of the Social Democrats (SPD), Green Party, and Free Democrats (FDP), and will now be incorporated into the plan. Additional capacities of 5 GW will be built by 2035-2040 [14], [15]. A database of hydrogen projects created by THEMA reveals that the announced generation of green hydrogen for the whole of Europe to date totals 25 GW which shows that the supply of green hydrogen falls short of the increasing demand. Where Germany only contributes 3.53 GW in comparison to the set target of 5 GW by 2030 and gap is there to be filled.

Figure 6: The projected hydrogen production rate in Germany against the 2030 and 2040 climate goals. Germany shows great potential and capacity for growth in the hydrogen production sector. Data for this graph has been supplied by Thema, 2021

4. The Hydrogen Markets in France

The annual usage of hydrogen in France is 900,000 tonnes. Most notably, it is employed in the production of chemicals, steel, and refinery. This amount produces 11.5 million tonnes of carbon dioxide, or 3% of all emissions in France. Grey hydrogen, or hydrogen derived from fossil fuels, contributes to the production of 116 million tonnes of carbon dioxide annually on a global scale. The “REPowerEU” programme, which aims to boost the green transition, the variety of the energy mix, and therefore the European Union’s energy independence, was presented by the European Union in May 2022. The EU presented the specific guidelines for what may be considered green or renewable hydrogen on February 13, 2023. It must be created using a renewable process, like electrolysis, and it must be powered by a sustainable energy source.

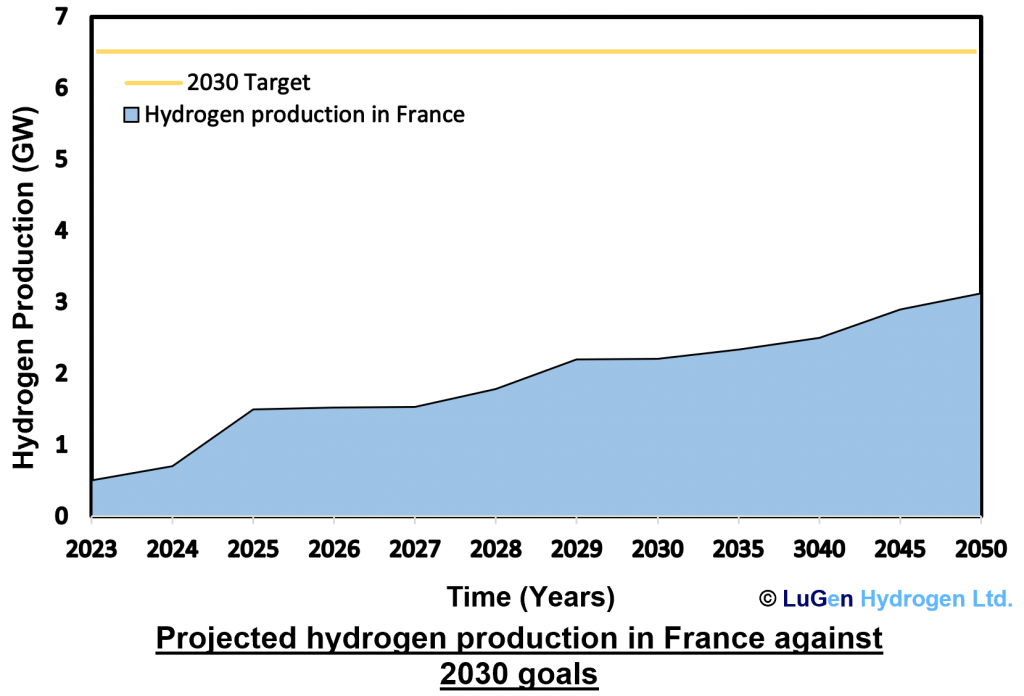

Here, France has an edge because of nuclear energy, which has been recognised as a renewable energy source. Only 1% of the hydrogen produced worldwide is green hydrogen at the moment. The preference for grey hydrogen can be attributed to its lower production costs, which are thought to be three to six times lower than those required to produce green hydrogen through electrolysis. The French Chamber of Commerce and Industry estimates that 20% of the effort to keep global warming to 2% might come from more consistent generation of green hydrogen. The France Hydrogen Association is attempting to do this by lowering the generation of grey hydrogen to 1.07 million tonnes annually by the year 2030. The European Union, on the other hand, intends for France to purchase 10 million tonnes of green hydrogen and manufacture 10 million tonnes of it domestically (14% of the total electricity consumed by the EU) [16], [17]. France initially released its hydrogen plan in 2018 and then its national hydrogen strategy in 2020. The step taken is focusing on “decarbonized” or emissions-free hydrogen generation, which is expected to help decarbonize industries with high emissions (steelmaking, cement, fertilisers, long-distance transportation, and aviation). By 2030, 6.5GW of electrolysis capacity was the goal of the initial French hydrogen policy, which was published in 2020 [18], [19].

Figure 7: The projected hydrogen production rate in France against the 2030 climate goals. France shows less potential for hydrogen production. In the future, France is forecasted to become a net consumer of hydrogen, importing from other regions to comply with commitments to reduce Green House Gas - Carbon Dioxide Equivalence emissions (GHG). Data for this graph has been supplied by Thema, 2021

According to Thema Recent report France has only planned to build around 2 GW of hydrogen production facilities [20] and there is almost a requirement of more than double of its planned capacity to meet its 2030 goals. Moreover, as a commitment to European Union, France need to import the same amount from other countries in order to compliance with its commitments to reduce GHG emissions and promote the usage of clean energy production systems.

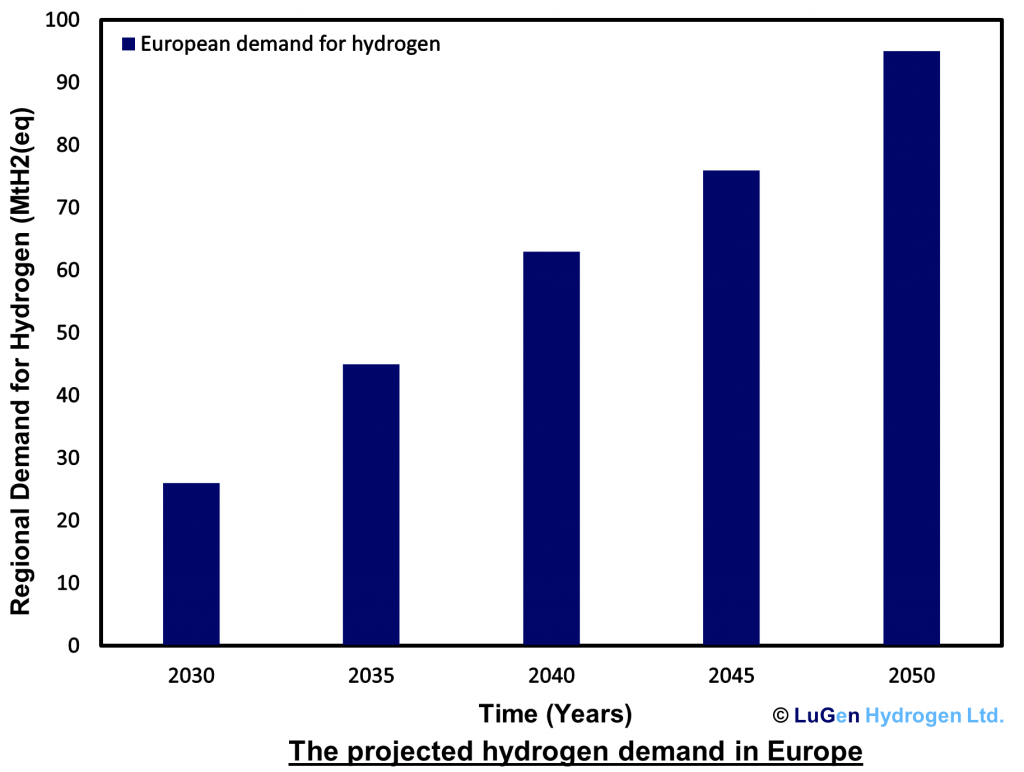

5. A Case for Green hydrogen: Energising the path to net zero in Europe

Globally 250 MtH2eq, or 42% of overall demand, for clean hydrogen is expected from the iron, steel, and other industries by 2050. By 2050, the transportation industry alone will likely use 215 MtH2eq of clean hydrogen, or 36% of all clean hydrogen consumption. Another 125 MtH2eq of hydrogen, or nearly one-fifth of the total demand, will be needed by 2050 for the energy storage and flexibility services that hydrogen can provide in the power system. Because of these factors, it is anticipated that the need for hydrogen in buildings will remain small (5 MtH2eq in 2050, less than 1% of overall needs). In similar manners Europe’s demand has been increasing annually and expected to 95 MtH2eq by 2050 [21].

Figure 8: The growing hydrogen demand in Megatons in Europe, forecasted to 2050. The trend is linear, showing consistent and sustainable growth in the market. Deloitte, 2023

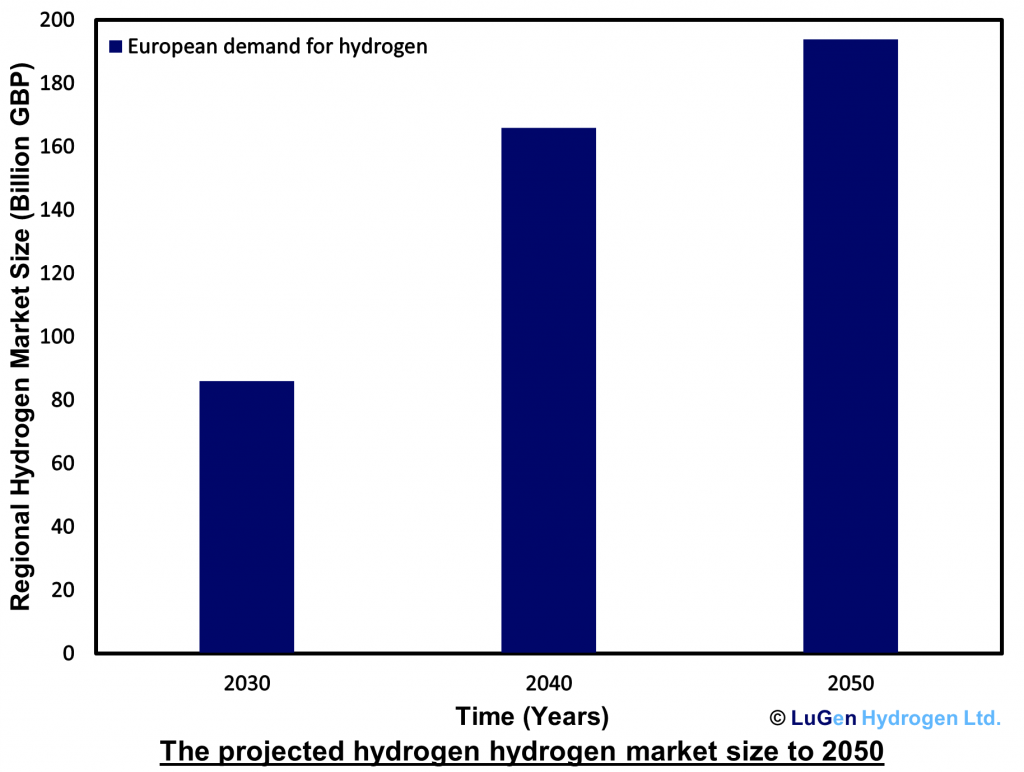

With clean hydrogen driving demand and growth, the overall market can grow substantially, and it Is expected to increase the overall market of hydrogen for Europe from 67 billion pounds in 2030 to 151.5 billion pounds in 2050.

Figure 9: The projected hydrogen market size in Europe, forecasted to 2050. The market size shows a correlation with the climate targets of 2030 and 2050. Data for this graph has been supplied by Deloitte, 2023

6. Conclusion:

The global hydrogen market is experiencing significant growth driven by the rising demand for low-carbon hydrogen and government commitments to reduce carbon footprints. Green hydrogen is in high demand across various industries such as power, steel, shipping, and aviation due to the transition to cleaner energy sources and the pursuit of net-zero goals.

By 2030, the global market for green hydrogen is projected to reach £103 billion, with hydrogen adoption expected to account for about 3% of global energy demand by 2050. Further Deloitte analysis identified the global announced gap of 105 GW [21] and THEMA identified the gap in Europe of 12 GW [20] which is 11.42 % of the global gap complimenting the gap identified here for Germany, UK and France.

The majority of hydrogen production currently relies on fossil fuels, there is a growing emphasis on renewable energy-based electrolysis. However, certain barriers, including market confidence, consumer awareness, and infrastructure investment, need to be addressed to fully unlock the potential of hydrogen. Additional investments in renewable energy sources and infrastructure are crucial to bridge the gap between the demand and supply of green hydrogen in Europe. In the UK, immediate action is required to fill the low-carbon hydrogen production capacity gap.

The government has set ambitious targets of achieving 5 GW of low-carbon hydrogen generation capacity by 2030 and increasing funding and support for research and development in hydrogen technologies. Similarly, Germany aims to develop a value chain for green hydrogen, investing in reaching a production threshold of 5 GW of renewable hydrogen by 2030.

France is also focusing on decarbonized hydrogen generation and aims to reduce grey hydrogen production while increasing green hydrogen production. France plans to expand its production capacity and import hydrogen to meet its 2030 goals. To achieve sustainable and carbon-neutral energy systems, Europe needs to make additional investments in renewable energy sources and infrastructure, creating a supportive ecosystem and implementing effective policies in the hydrogen market.

According to a study by Bloomberg NEF, constructing dedicated wind, solar, and electrolysis capacity in Europe would require 1.5 terawatts of new wind and solar power and 1 terawatt of electrolysis capacity. An alternative solution to reduce the need for dedicated renewable energy for electrolyzers is to power them with surplus green energy generated by grid-connected wind and solar. By maximizing the use of curtailed wind and solar power, Europe could decrease the amount of renewable electricity required for hydrogen production by 20% or 1.2 terawatts by 2050 [22].

Figure 10: The additional requirement of renewable energy sources to generate green hydrogen in Europe, shows that electrolysers are largely connected to dedicated wind-solar power plants to meet the production requirement. Growth in the offshore renewable sector is also expected. Data for this graph has been supplied by Bloomberg, 2022

References

[1] “Hydrogen: the US$600 billion investment opportunity | Wood Mackenzie.”

https://www.woodmac.com/news/opinion/hydrogen-the-us$600-billion-investment-opportunity/ (accessed Jul. 10, 2023).

[2] “Hydrogen Fuel Cells Market Size, Growth, Trends, Report 2022 to 2030.”

https://www.precedenceresearch.com/hydrogen-fuel-cells-market (accessed Jul. 10, 2023).

[3] “Green Hydrogen Market Size | Trend Forecast Report 2030.”

https://www.strategicmarketresearch.com/market-report/green-hydrogen-market (accessed Jul. 10, 2023).

[4] A. Chapman et al., “A review of four case studies assessing the potential for hydrogen penetration of the future energy system,” Int. J. Hydrogen Energy, vol. 44, no. 13, pp. 6371–6382, Mar. 2019, doi: 10.1016/J.IJHYDENE.2019.01.168.

[5] E. R. Sadik-Zada, E. D. Santibanez Gonzalez, A. Gatto, T. Althaus, and F. Quliyev, “Pathways to the hydrogen mobility futures in German public transportation: A scenario analysis,” Renew. Energy, vol. 205, pp. 384–392, Mar. 2023, doi: 10.1016/J.RENENE.2022.12.087.

[6] B. Lux and B. Pfluger, “A supply curve of electricity-based hydrogen in a decarbonized European energy system in 2050,” Appl. Energy, vol. 269, p. 115011, Jul. 2020, doi: 10.1016/J.APENERGY.2020.115011.

[7] R. L. Edwards, C. Font-Palma, and J. Howe, “The status of hydrogen technologies in the UK: A multi-disciplinary review,” Sustain. Energy Technol. Assessments, vol. 43, p. 100901, Feb. 2021, doi: 10.1016/J.SETA.2020.100901.

[8] “2019 UK greenhouse gas emissions, provisional figures”.

[9] “Energy Trends: UK renewables – GOV.UK.”

https://www.gov.uk/government/statistics/energy-trends-section-6-renewables (accessed Jul. 10, 2023).

[10] “Net Zero The UK’s contribution to stopping global warming Committee on Climate Change,” 2019, Accessed: Jul. 10, 2023. [Online].

Available: www.theccc.org.uk/publications

[11] “Britain’s hydrogen strategy is ambitious, if imperfect.”

https://www.economist.com/britain/2022/07/25/britains-hydrogen-strategy-is-ambitious-if-imperfect?utm_medium=cpc.adword.pd&utm_source=google&ppccampaignID=18151738051&ppcadID=&utm_campaign=a.22brand_pmax&utm_content=conversion.direct-response.anonymous&gclid=Cj0KCQjwtamlBhD3ARIsAARoaEytRqbilLXUOVvvJKbvoP_egc3SxmZp70v_M7wQE8DOo8NCLJ_veM4aArZFEALw_wcB&gclsrc=aw.ds (accessed Jul. 10, 2023).

[12] “First Special Report – The role of hydrogen in achieving Net Zero: Government Response to the Committee’s Fourth Report – Science and Technology Committee.”

https://publications.parliament.uk/pa/cm5803/cmselect/cmsctech/1257/report.html (accessed Jul. 10, 2023).

[13] “UK Strategy encourages development of the supply and demand needed for hydrogen to realize its decarbonization potential | S&P Global Commodity Insights.”

https://www.spglobal.com/commodityinsights/en/about-commodityinsights/media-center/press-releases/2021/081721-uk-strategy-encourages-development-supply-demand-needed-hydrogen-realize-decarbonization-potential (accessed Jul. 10, 2023).

[14] “Package for the future – Hydrogen Strategy – Policies – IEA.”

https://www.iea.org/policies/11561-package-for-the-future-hydrogen-strategy (accessed Jul. 10, 2023).

[15] S. Hanke, “Ampel entwickelt Wasserstoffstrategie weiter,” Tagesspiegel Backgr. Energ. Klima, Mar. 2023, Accessed: Jul. 10, 2023. [Online].

Available: https://background.tagesspiegel.de/energie-klima/ampel-entwickelt-wasserstoffstrategie-weiter

[16] “Green hydrogen in France: the promise of 50,000 to 150,000 jobs – Business France.”

https://www.businessfrance.fr/discover-france-news-green-hydrogen-in-france-the-promise-of-50-000-to-150-000-jobs (accessed Jul. 10, 2023).

[17] “France’s Hydrogen Strategy: Focusing on Domestic Hydrogen Production to Decarbonise Industry and Mobility | IDDRI.”

https://www.iddri.org/en/publications-and-events/report/frances-hydrogen-strategy-focusing-domestic-hydrogen-production (accessed Jul. 10, 2023).

[18] “HYDROGEN POLICY: France to have new national hydrogen strategy by the end of H1 2023 | ICIS.”

https://www.icis.com/explore/resources/news/2022/12/08/10833939/hydrogen-policy-france-to-have-new-national-hydrogen-strategy-by-the-end-of-h1-2023/ (accessed Jul. 10, 2023).

[19] “‘France 2030’ Investment Plan- Hydrogen sector funding – Policies – IEA.”

https://www.iea.org/policies/14465-france-2030-investment-plan-hydrogen-sector-funding (accessed Jul. 10, 2023).

[20] “Hydrogen – Thema.”

https://thema.no/en/energy-markets/hydrogen/ (accessed Jul. 10, 2023).

[21] “Green hydrogen: Energizing the path to net zero | Deloitte Germany.”

https://www2.deloitte.com/de/de/pages/sustainability1/articles/green-hydrogen.html?id=de:2ps:3gl:4green-hydrogen-report:5:6er:20230614::&gclid=CjwKCAjw-vmkBhBMEiwAlrMeF8vf42vVyzTy77s_wu81OsWpVQ-40LI6kozZ4O3k_JqFdfm8fJxizhoClPwQAvD_BwE (accessed Jul. 10, 2023).

[22] “Europe’s Path to Clean Energy: A $5.3 Trillion Investment Opportunity | BloombergNEF.”

https://about.bnef.com/blog/europes-path-to-clean-energy-a-5-3-trillion-investment-opportunity/ (accessed Jul. 10, 2023).